Books

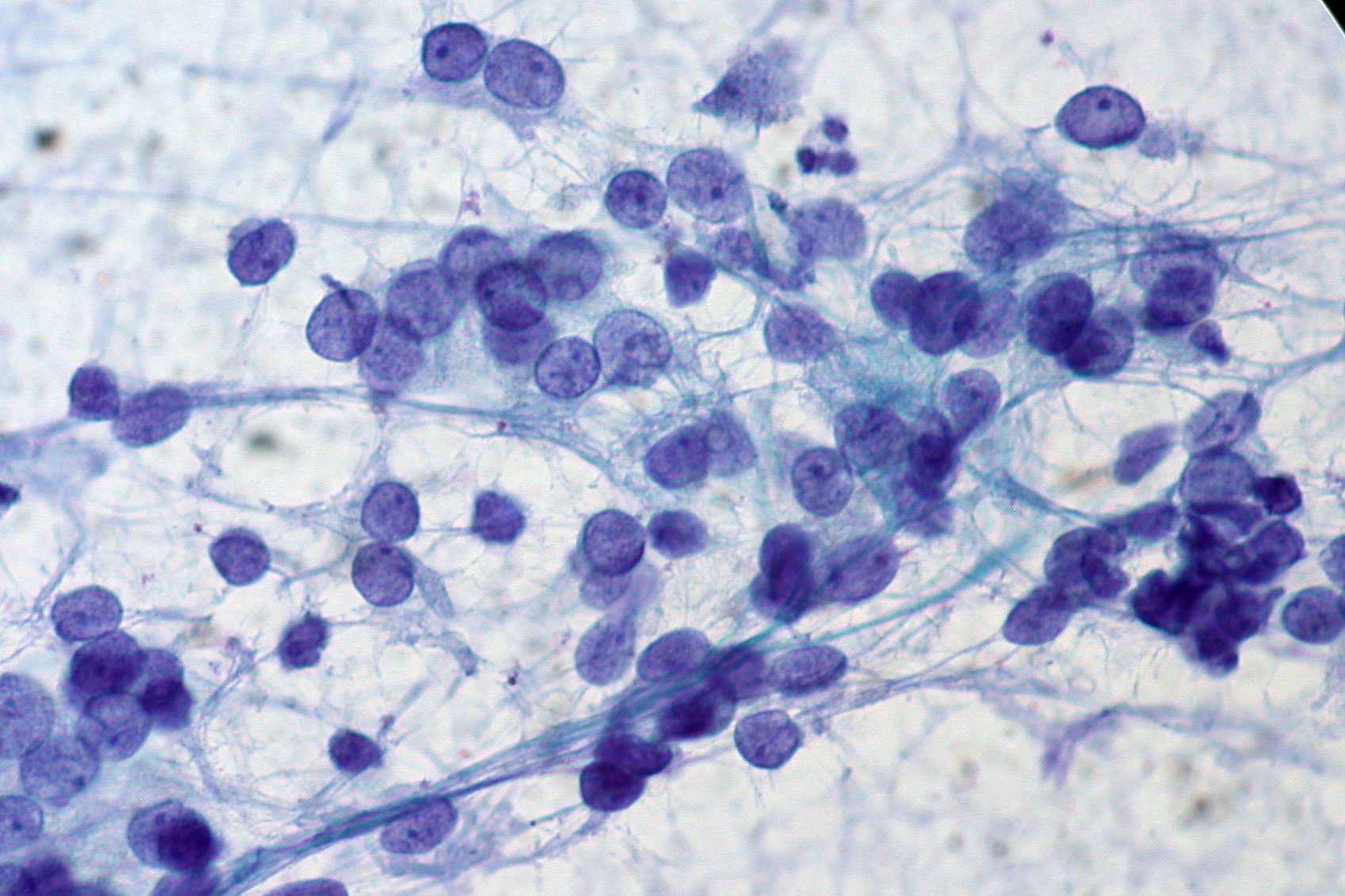

THE PHARMAGELLAN GUIDE TO ANALYZING BIOTECH CLINICAL TRIALS is a comprehensive primer to help non-experts evaluate clinical studies of new therapies.

If you work in or around biotech, you’re supposed to understand clinical trial results. But what if you’re not an expert in study design or biostatistics? You may feel out of your comfort zone when faced with a journal article, press release, or investor presentation. That’s where this guide comes in:

Structured roadmap for assessing the main components of a planned or completed biotech trial.

Clear explanations of the most common concepts and terms in clinical studies, illustrated with over 100 real-world examples.

Deep dives on essential topics like P values, sample size calculations, and Kaplan-Meier curves, written in plain English for non-statisticians.

Pointers for interpreting positive and negative results, understanding common figures and tables, and identifying red flags in press releases.

If you’re a biotech executive, investor, adviser, or entrepreneur – or aspire to be one – this handbook will give you the foundation you need to analyze clinical trials with more confidence.

Get a free excerpt: “Interpreting Efficacy Findings in Biotech Clinical Trials”

Email us for info on instructor review copies

“The best explainer I’ve ever seen. It spills all the secrets!”

“I wish I’d had a book like this earlier in my career.”

“A must-read for non-experts to level up your understanding of drug development.”

“Wise advice on when to rely on clinical data and when to be skeptical.”

“A source of much-needed illumination.”

THE PHARMAGELLAN GUIDE TO BIOTECH FORECASTING AND VALUATION is a comprehensive, thoroughly referenced handbook for biotech executives, investors, dealmakers, entrepreneurs, and advisers – and everyone who aspires to be one. It contains key data to help you create and interpret financial models for early-stage biopharma assets and companies:

Vetted benchmarks for key drivers of income, expenses, and valuation.

Proprietary analyses by Pharmagellan’s experienced consulting team.

More than 150 current references from peer-reviewed research, industry white papers, and SEC filings.

Whether you’re making investment decisions, pitching to potential funders or partners, or assessing your own R&D program, this is the one-stop guide you need by your side.

Get a free excerpt: “Projecting Market Share for R&D-Stage Biotechs”

Read the foreword by biotech investor David Sable, MD

Email us for info on instructor review copies

“Deserves a spot on the bookshelf of every biotech CFO.”

“A helpful and insightful resource for anyone who finds themselves staring at a blank Excel spreadsheet.”

“Pragmatic, credible advice ... this is the book I wish I’d had when I started out in the industry.”

“Invaluable, rigorously detailed, and well-validated.”