Research and Resources

PUBLICATIONS

For more information about our research activities or reprints of paywalled papers, contact us at info@pharmagellan.com.

Pitch deck tips for biotech and medtech start-ups

A Google search for "biotech pitch decks" returns lots of hits — but many of them are irrelevant to drug and device newcos. Have no fear — we've compiled a list of the best resources (updated 12/22/2021).

Introductory resources for analyzing biotech clinical trial results

If you’re just getting started trying to understand biotech press releases, investor decks, journal articles, and conference posters — we’ve got you covered with the must-read books, articles, and blog posts for beginners.

Improving POS prediction for clinical trials

Investors and drug developers use a clinical trial’s probability of success (POS) as a key input into strategic and financial decisions. However, standard methods of estimating POS — via historical data or eliciting input from internal and external experts — are inaccurate, subject to bias, and/or hard to scale. In this paper, we worked with the firm Diviner to describe their novel method for predicting clinical POS that addresses these challenges by using anonymized external expert panels. (Photo: TheAndrasBarta)

Article in Drug Discovery Today (December 2025; email for reprint)

Measuring biopharmaceutical innovation in the modern era

Innovation in drug development has historically been measured mainly by counting things like drug approvals, patents, and R&D investments. But these factors make it hard to distinguish between transformative and incremental advances. In work led by UCSB’s Sukhun Kang, we propose a more comprehensive set of metrics that does a better job of capturing clinical, economic, and social value. (Photo: Chokniti Khongchum)

Essay on The Incidental Economist (August 2025)

Platform trials for rare disease drug development

Rare disease clinical trials are often difficult to set up and expensive to execute. But what if multiple companies could collaborate by testing their drug candidates into a single trial with shared infrastructure and a common control arm? In this white paper for Institute for Progress, we propose that the FDA and NIH should fund platform trials in rare diseases to increase the efficiency of drug R&D in these challenging indications. (Photo: Pixabay)

Whitepaper (January 2025)

Introductory essay by Institute for Progress: “The Case for Clinical Trial Abundance”

Cancer drug access and innovation under the Inflation Reduction Act

Many drug pricing partisans claim that either (a) the Inflation Reduction Act (IRA) will kill drug R&D or (b) we already know conclusively that the law has no effect on the development of new therapies. But in fact, as we point out in this piece with Stacie Dusetzina of Vanderbilt, neither position is backed up with data. We argue that more time and analyses are needed to assess the law’s full impact, explain why cancer is likely to be the “canary in the coal mine” for the IRA’s effects on biopharma innovation, and propose several specific assessments that should be performed. (Photo: Pixabay)

Article in JAMA Oncology (October 2024)

How do biotech VCs view drug R&D incentives?

Can we sustain or even boost innovation in the face of looming efforts to rein in drug prices? Together with Rena Conti of Boston University and Gabriela Gracia, we solicited ideas from leading biotech VCs. They told us that early-stage funding of innovative biopharma R&D can survive the imposition of price controls, provided that significant efforts are made to permit “value-based pricing” for valuable new therapies and correct “market failures” like antibiotics. (Photo: Pixabay)

Analysis on the Health Affairs Blog (July, 2022)

Does Boston have too many clinical trials?

Sometimes it seems like every drug company is running trials at the same centers — and others are getting passed over. To what extent are some cities significantly “over-trialled” on a per capita basis compared with others — and why? As a first step toward answering this question, we explored disparities in trial access across U.S. urban areas.

Article in JAMA Network Open (February, 2020)

Blog post about the implications for biopharma companies

More on our new clinical trial info curation and annotation system, TrialHunt

Getting the incentives right in biopharma R&D

Would lower drug prices stifle biopharma innovation? Not necessarily. Yes, R&D depends on expected returns, but we can use other tools besides high prices to reward investors for funding transformational drug research. Together with Rena Conti of Boston University, we review the evidence and propose ways to balance price with other incentives to get the drugs we need, at costs we can afford. (Photo: Paul Roberts)

Analysis on the Health Affairs Blog (July, 2019)

How smart pharma can stop making bad R&D choices

Pharma R&D portfolio planning is great for budget allocation, but in terms of informing strategy, it misses the mark. In collaboration with Greg Belogolovsky of Navigant, we review the shortcomings of the current process, and propose a way to improve it with rigorous, regular post-hoc reviews by outside experts.

Stock price effects of breakthrough therapy designation

Breakthrough therapy designation (BTD) provides manufacturers with regulatory benefits — but how is it perceived by investors? We conducted an event study to examine how stock prices of commercial and pre-commercial drug makers react to public announcements of BTD. (Bottom line: not much, and only transiently.)

Article in Nature Reviews Drug Discovery (January, 2019; open access)

Coverage and analysis by MedCityNews, Endpoints, and “In The Pipeline”

Preventing the next Marathon Pharmaceuticals

In 2017, Marathon Pharmaceuticals obtained U.S. approval for the steroid deflazacort in Duchenne's muscular dystrophy. But the company came under fire for setting a high price for a drug that was long available for a pittance in Europe, despite having spent next to nothing on further research. Can we — and should we — prevent this type of behavior in the future? We analyzed the regulatory and pricing context, and also determined the likelihood of similar scenarios in the future. (Image: ccpixs.com.)

Article in F1000 Research (January, 2018; open access)

Physician profits from Medicare Part B

Under current reimbursement rules, doctors are economically incentivized to administer high-priced infused and injected drugs — but do they really prioritize profits over patients? We used public Medicare data to try to estimate how much money is really at stake, and whether it's likely to change prescribing behavior.

Analysis on The Health Care Blog (June, 2017)

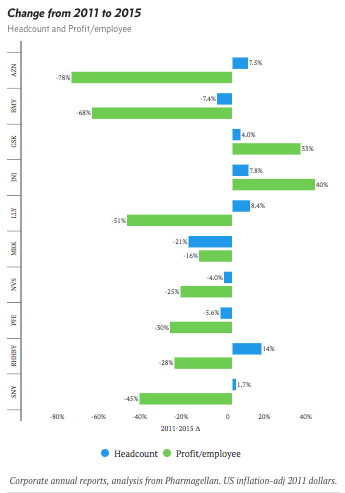

The myth of “leaner and meaner” pharma

Drug makers commonly tout layoffs and reorganizations as tools to boost productivity. But have they really improved the "return on talent"? We examined total headcount and profit per employee to see if these efforts are paying off.

Analysis on Endpoints.com (June, 2017)

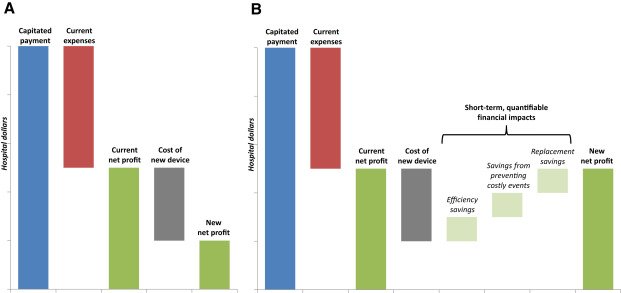

Value-based surgical innovation

Warren Buffett famously said that, "Price is what you pay, value is what you get." But does "clinical value" to patients really matter to the folks who actually pay for medical devices and drugs? We asked hospital CFOs and other financial stakeholders how they evaluate new products in a capitated payment setting, the inpatient operating room. (Spoiler alert: long-term clinical value is nice, but it doesn't balance the books.)

Article in Surgery (May, 2017; open access)

Historical trends in pharma R&D spending

Prior analyses of pharma R&D and SG&A spending have focused on each category as a percent of revenues. In this work, we instead look at historical trends over time to discover how drug companies choose to allocate resources, particularly when revenues are pressured.

Potential clinical impact of “reciprocal approval” legislation

Pharma regulatory strategy would be radically transformed if the FDA were compelled to automatically consider drugs already approved in other countries for market approval. In this cohort analysis, we measure how U.S. patients could be affected by this proposed policy.

Article in BMJ Open (Feb., 2017; open access)

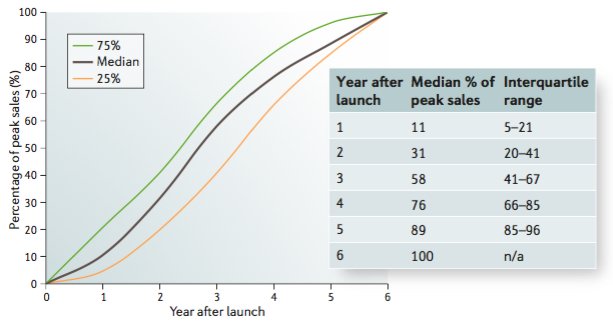

Drug launch curves in the modern era

The historical view of prototypical drug launches is based on 30-year-old work focused on cardiovascular medicines. Here, we update those data and provide a revised view of ramp rates of "pioneer" and "follower" drugs.

Creating value with financially adaptive clinical trials

Clinical development planning and financial analysis are traditionally conducted in separate silos. In this piece, we illustrate the benefits that drug companies can reap by integrating these activities.